Strategies

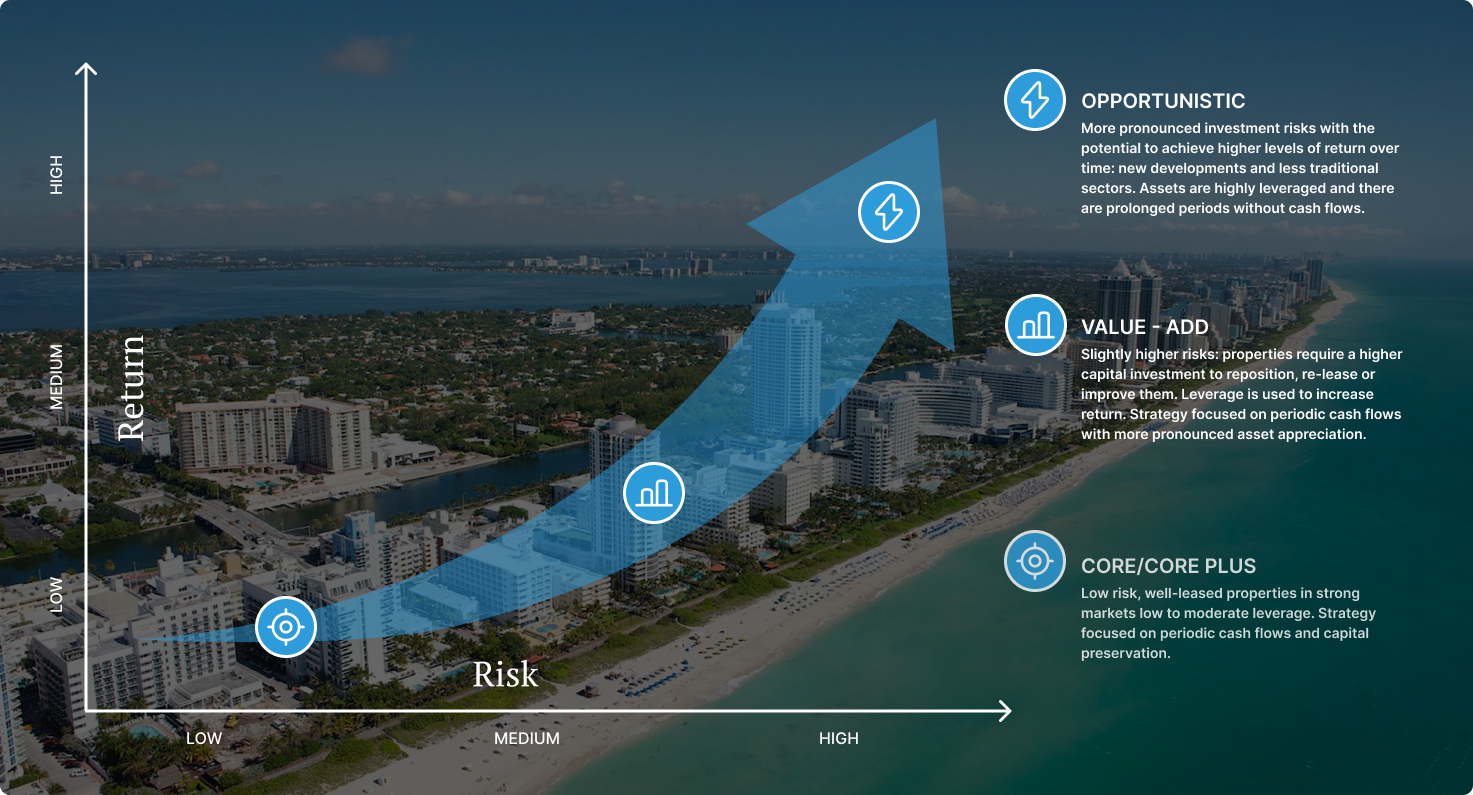

Midtown Capital specializes in the creation of value by sourcing, acquiring, developing and operating commercial property. With a long-term perspective, we offer our investors flexible strategies to diversify their real estate portfolio by establishing a clear investment thesis and a healthy risk/return balance, with an emphasis on capital preservation. We steer our clients towards building a solid foundation of Core and Core+ strategies with a combination of Value Add and Opportunistic initiatives.

Having the flexibility to select between different investment structures allows our investors to build their investment portfolios with greater efficiency. Midtown Capital currently manages 22 investment vehicles in a co-investment or fund model, represented in over 3 million square feet of industrial, multifamily, retail and office assets.

Co-Investment

- Purchase of assets with participation of several investors

- Minimum investment of $500k

- Minimum value per asset: $20M Institutional quality assets

- Allows clients to build their portfolio on an asset-by-asset basis

- Audited vehicles

Funds

- Investment in vehicles that invest in multiple properties, diluting the impact of any contingency in any specific asset.

- Minimum investment: $500K

- Institutional quality assets

- Greater diversification

- Audited vehicles

- Reputable fund administrators

Separate Accounts

- Tailor-made investment in one or several assets without the participation of other investors.

- Minimum property value: $5M

- Full control over investment strategy, financing and sales